The "One Big Beautiful Bill" (OBBB), officially the One Big Beautiful Bill Act, passed by the House in May 2025, has drawn significant criticism for its fiscal and social impacts. This is not an exhaustive list, but below are the primary criticisms, based on analysis from various sources:

Lack of Transparency and Rushed Process: The 1,038-page bill’s complexity and late release of text led to Republican lawmakers, like Representatives Mike Flood and Marjory Taylor Greene, admitting they missed problematic provisions, such as States not being able to regulate Artificial Intelligence for ten years. Critics argue the rushed reconciliation process, requiring only a simple majority, sidelined a thorough review, amplifying unintended consequences.

Massive Deficit Increase: Critics argue the bill significantly increases the federal deficit, with the Congressional

Budget Office (CBO) estimating it will add $2.4 trillion to $3.8 trillion to the national debt over a decade,

despite claims of $1.7 trillion in savings. The extension of the 2017 Tax Cuts and Jobs Act (TCJA) and new tax breaks, contribute heavily, with economic growth offsetting only 22% of the tax cuts’ cost. Critics, including

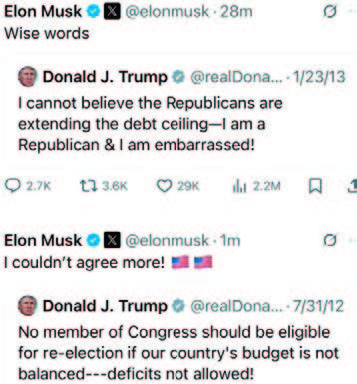

Senators Rand Paul and Ron Johnson, and Elon Musk, who called the OBBB a “disgusting abomination,” highlight the debt increase as fiscally irresponsible, especially with a $4 trillion debt ceiling hike. Musk had an actual physical altercation in the White House with Treasury Secretary Scott Bessent, presumably over the reckless spending in the Bill, and it is speculated that’s why Musk was seen with a black eye. President Trump and Musk have had a falling out, with Musk reposting Trump’s old tweets that expose the reverse of his current position on the OBBB. (See right).

Senators Rand Paul and Ron Johnson, and Elon Musk, who called the OBBB a “disgusting abomination,” highlight the debt increase as fiscally irresponsible, especially with a $4 trillion debt ceiling hike. Musk had an actual physical altercation in the White House with Treasury Secretary Scott Bessent, presumably over the reckless spending in the Bill, and it is speculated that’s why Musk was seen with a black eye. President Trump and Musk have had a falling out, with Musk reposting Trump’s old tweets that expose the reverse of his current position on the OBBB. (See right).

Regressive Tax Policy: The bill is criticized as a “reverse-Robin Hood” scheme, favoring the wealthy while harming lower-income households. It boosts incomes for the top 1% by nearly $70,000 annually ($124 billion total) and quadruples the state and local tax (SALT) deduction cap to $40,000, benefiting high earners in high-tax Blue states. Meanwhile, the bottom 10% of earners face a 4% income reduction by 2034, per the CBO.

Not All Tax Breaks Are Permanent: The “No Tax on Tips” and “No tax on Overtime” expire December 31st, 2028. The Child Tax Credit expansion reverts back from $2,500 per child to $2,000 on December 31st, 2029. Also expiring in 2028 are the $4,000 additional standard deduction for seniors, and the deduction for auto loan interest on American made cars.

Spending on Pet Projects: Critics highlight wasteful spending, including $50 billion for a border wall (eight times higher than Customs and Border Patrol’s estimate) and $45 billion for private prison expansion to support mass deportations, benefiting connected contractors like GEO Group. The $350 billion for border security and military spending is seen as excessive, and includes initial funding for Trump’s “Golden Dome” missile defense system similar to the one in Israel that just failed and can’t compete against cheap modern drone technology, estimated to cost $175B over three years to complete. The Bill increases farm subsidies, which critics say will raise grocery prices. It includes something called “The Orphan Cures Act” which allows more drugs to avoid Medicare price negotiation. According to Senator Rand Paul, the OBBB gives World Cup Soccer $695M.

Who knows what else is hidden and yet to be discovered.

House Speaker Mike Johnson said starting over with a better bill is unacceptable because this one took fourteen months to write. Which begs the question of who wrote this bloated bill and why did legislators not even seem to know what’s in it? The Senate may modify these provisions, as early signals suggest adjustments, and the OBBB is still under consideration.

One Big Beautiful BS? You decide.